Looking Anew at Trade

Opportunities to Strengthen US Strategic Competitiveness

By Mark Kennedy

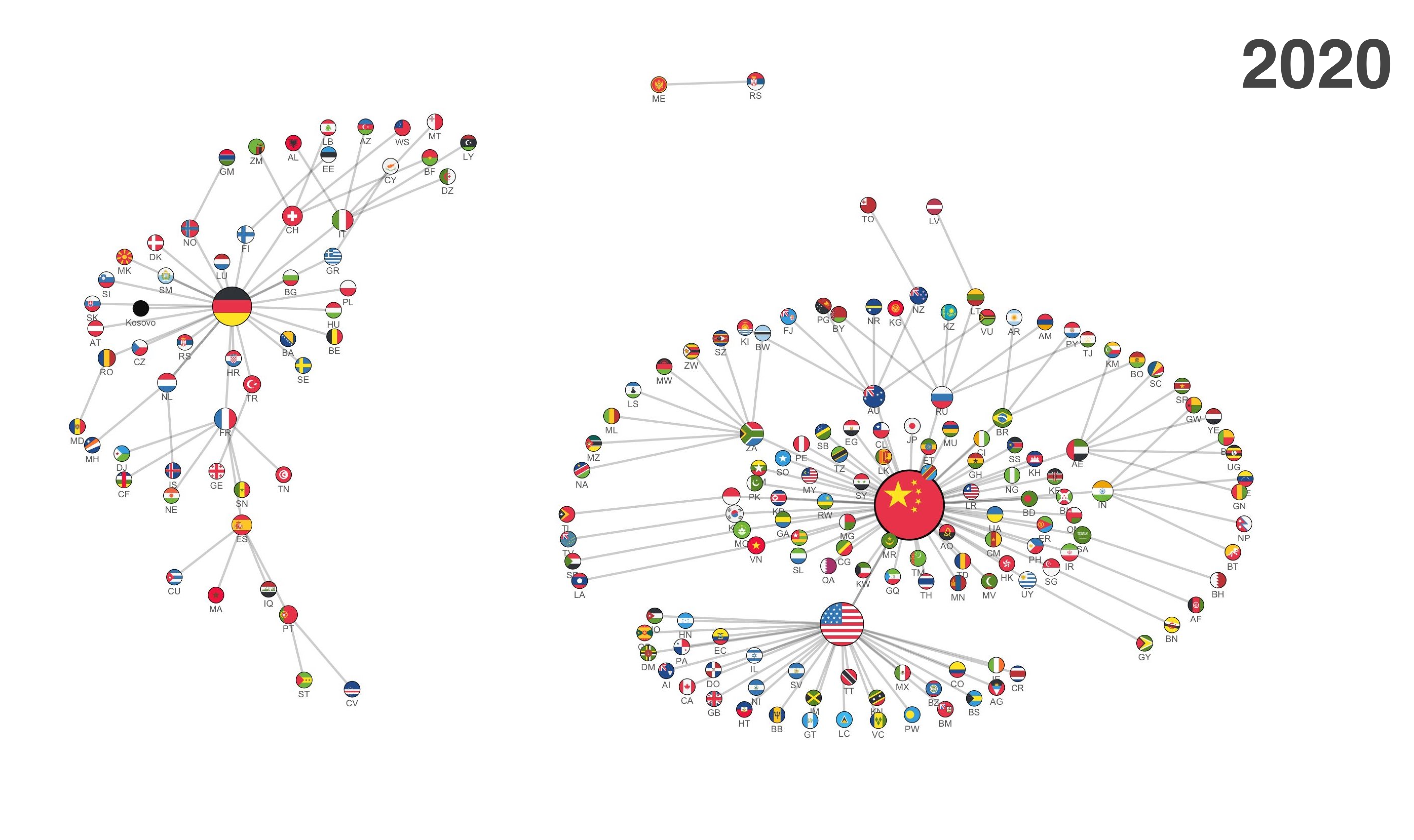

Recently, there has been great debate over the pros and cons of trade, with political leaders falling on both sides. The seeds of the current US trend away from trade were planted by the left in protests at the 1999 World Trade Organization Ministerials in Seattle, and again in Geneva in 2009. This resistance blossomed into a greater focus in trade negotiations around improving labor standards, boosting environmental protections and gender equality, and protecting the marginalized; highlighting these benefits of expanded trade as trade liberalization continued to advance. More recently, former President Donald Trump's protectionist views took root, reversing trade liberalization, which culminated in escalated tariffs on China and allies alike.

President Trump's persistent attacks on trade initially increased the number of Republicans viewing trade as an opportunity for economic growth, but their support plummeted with the election of a Democratic president. Prior to this, favorable Republican views of trade had not varied by who was president, allowing President Bill Clinton to pass the North American Free Trade Agreement and President Barack Obama to advance—and ultimately pass—the Trans-Pacific Partnership, both in partnership with Republican controlled Congressional chambers.

Source Gallup

Where does that leave us now? Even with most Americans viewing trade as an opportunity for growth, the conventional wisdom in Washington is that trade is dead.

Examining the Resistance

There is little doubt that labor markets have disrupted lives, but this is largely due to technological advances, not trade. The Washington Post gave two Pinocchio's to the claim that the principal reason for job loss has been bad trade policy. This McKinsey study and Ball State research underscore this point. In fact, other than during periods of broad economic slowdown, US manufacturing has risen, even as technological advances have caused manufacturing jobs to fall.

Employmentin millions

Real OutputSeasonally Adjusted (2009 = 100)

US ManufacturingRebased (1980 = 100)

Amid the ongoing trend of reductions in manufacturing jobs driven by growth in technology to accelerate productivity, research shows that in the Midwest and the South, imports from China did reduce manufacturing jobs in the United States between 2000 and 2007. However, there is no evidence of trade with China costing jobs after 2010.

An October 2022 study by the US International Trade Commission found that job losses from trade were concentrated in “low-skill” workers, which seems to be best addressed by worker retraining and education, rather than pulling back from trade. Nearly every new trade negotiation is paired with increased support for those impacted by the shifting economic environment. Rather than forgo the many benefits of trade, a focus on supporting more effective transitions seems appropriate.

Researchers' concern with job losses over job gains stemming from trade might help to explain misperceptions. The US International Trade Commission report also found that “other dimensions [of trade's impact], including effects of exports or services trade, remain relatively underresearched.” In fact, researchers found that earlier manufacturing job losses were largely offset by a growth in service jobs.

One in Five Jobs in America Supported by Trade

The truth is that nearly one in five US jobs are supported by trade.

Source Trade Partnership Worldwide

These jobs are supported by trade across the globe

Source Business Roundtable

Jobs created by trade with by US state

More trade would mean more jobs. The US Trade Representative estimates that “Every $1 billion in new exports of US goods supports more than 6,000 additional jobs here at home. Every billion dollars of services exports supports more than 4,500 jobs.”

The fact is that America ranks second only to China in merchandise exports, ranks number one in service exports, and has a surplus in services trade.

Tariffs are Costing Jobs

Too few Americans—and US policymakers—understand the harmful impacts of tariffs. A study by the Federal Reserve Board found that the tariffs imposed by the Trump administration have resulted in “relative reductions in manufacturing employment and relative increases in producer prices.” They found that the “small [jobs] boost from the import protection effect of tariffs is more than offset by larger drags from the effects of rising input costs and retaliatory tariffs.”

Tariffs on steel and aluminum are particularly harmful in that there are far more jobs in America that bend metal than that produce it. Higher costs of metals make them less competitive. One study of Trump-era tariffs found they “may have led to an increase of roughly 1,000 jobs in steel production…[and likely] resulted in 75,000 fewer manufacturing jobs in firms where steel or aluminum are an input into production.”

The US Department of Agriculture found that American farmers have lost an estimated $13.2 billion in revenues annually since 2018 due to retaliatory tariffs imposed as a result of the tariffs the US imposed at that time.

Trade Increases Incomes

Trade has benefited American incomes as the US continues to be the most prosperous major nation, even as trade helped lift hundreds of millions out of poverty in China, India, and beyond.

Part of the trade resistance is fueled by the assertion that trade is broadly hurting the middle class. Even with the disruptions caused by technology's advancement, and without the spike from the post-pandemic labor shortage, all income segments have broadly benefited from trade. Instances where jobs and incomes were lost in some firms are offset by jobs and incomes enhanced at other companies who exported more. The dips and spikes of the lowest quartile average are more reflective of variances in income transfers and overall competitiveness than varying trade measures.

As America Resists, Other Nations Partner on Trade

Trade resistance is largely confined to America. Other nations operate with the understanding that trade agreements give their exports an advantage over nations without such agreements, and are actively pursuing them to benefit their exports and their workers. Let's look at the numbers with these maps from the World Trade Organization.

America currently has 14 regional trade agreements, and is not actively negotiating additional trade agreements for market access in merchandise and services.

Click on a country to see its regional trade agreements.

Source: WTO

The European Union, itself a trade bloc encompassing 27 nations, has 45 regional trade agreements—more than three times as many as the United States—and is actively negotiating more agreements.

Other nations with more regional trade agreements than the United States include the United Kingdom with 38, Mexico with 23, South Korea with 20, Japan 18, India 17, Australia 17, and China with 16.

US Trade Policy Benefits China

China's trade practices have harmed other nations. Its subsidies of state owned companies, protections for national champions while discriminating against foreign companies, forcing tech transfers, and cyber theft of intellectual property have made it harder for US firms to retain a foothold in Chinese markets, and easier for Chinese competitors to succeed in global markets. The appropriate response is not for America to retreat from trade, but to compete more vigorously for exports in global markets.

The result of America's inward turn is to step aside as other nations negotiate preferential access and define the terms to trade, sacrificing the jobs that go with that trade and the influence that comes from the associated interactions. Perhaps no other nation has benefited more from America's trade resistance than China.

President Trump deserves credit for elevating concern about how China's actions and goals could undermine the rules-based world order, and harm American interests. Yet, it is hard to understand how his action of withdrawing the United States from the Trans-Pacific Partnership is anything but beneficial to China.

China has just joined the Regional Comprehensive Economic Partnership with 15 member countries—including US allies Australia, Japan, and South Korea. Partnership countries account for about 30 percent of the world's population and of global GDP, making it the largest trade bloc in history. China also seeks to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership that the United States initiated, then rejected.

One could make a strong argument that few things would harm America's future economic prospects more than being on the outside looking in as Asian agreements with China define the terms of trade, instead of being at the center of a Pacific trade agreement that reflects America's priorities and interests.

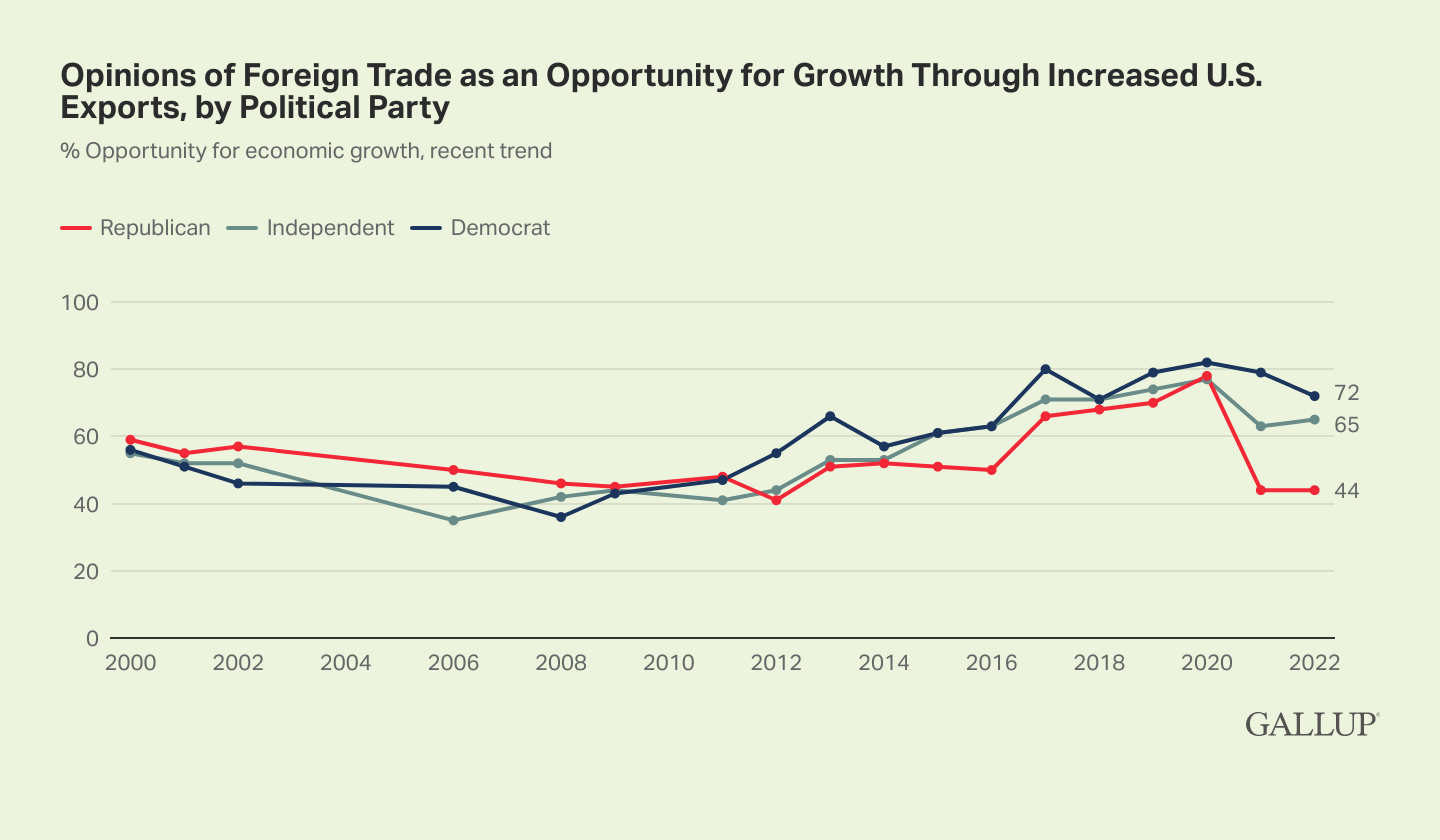

A further illustration of how America's retreat from trade leadership has benefited China is evident when you look at the evolution of other nations' leading trading partner between 1990 and 2020.

Slide divider to see trading partners in 1990 vs 2020

Visualizing Countries Grouped by Their Largest Trading Partner (1990 vs 2020), Visual Capitalist.

US Trade Policy and Alliances

Nations are significantly influenced by those nations with which they trade. Their economic livelihood depends on it. Even as China is a leading trading partner to more nations than the United States, America maintains it global leadership role in that it is perceived by others as having the ability to marshal action among a group of like-minded, largely democratic, countries.

When you look at a map based on whether Russia (in red) or America (in blue) is a nation's leading trading partner, you see a reflection of both the scale of the US economy, and how Russia was not as actively engaged in global commerce even before its assault on Ukraine.

US (blue) and Russia (red) and their corresponding leading trading partners.

Source: WTO Trade Profile Data

When you look at the map considering who is the largest trading partner when China is added to Russia, you see a sea of red, largely reflecting China's trading prowess.

US (blue) and Russia + China (red) and their corresponding leading trading partners.

Source: WTO Trade Profile Data

Yet when you consider the United States and the European Union together—partners often aligned on foreign policy matters—in comparison to China and Russia, the map changes radically. This reflects how vital a strong transatlantic partnership is to America's global leadership.

US + EU (blue) and Russia + China (red) and their corresponding leading trading partners.

Source: WTO Trade Profile Data

When you go further by adding America's three partners in the Quad—Australia, India, and Japan—to its EU partners, Asia tilts toward America and its allies. Those nations who still reflect rival powers as their primary trading partners are either satellite nations or resource rich countries. This highlights the importance of America and its allies intensifying their efforts to secure supply chains, and access to critical minerals.

US + EU + Quad (blue) and Russia + China (red) and their corresponding leading trading partners.

Source: WTO Trade Profile Data

These series of maps highlight the vital importance of America closely aligning with its allies. Recent actions reflect too little consideration to the impact that US trade policies have on the allies upon which it depends. For example, the electric vehicle tax credits harm manufacturers from America's closest allies, and likely violate existing trade commitments. Strategic competition measures, like America's restrictions on advanced semiconductor equipment, can only be successful if allies who produce such equipment, and whom America's electric vehicle tax credits impact—notably Japan and South Korea—sacrifice economic opportunities to align with America.

Advancing US Economic Interests

One gets the sense that there is a competition between America's political parties as to who can be more “tough on China.” The aim of the United States should be on lifting up itself as it lifts up others. With whichever lens you chose, the answer is the same. It is neither tough on China, nor good for America to forgoe mutually beneficial trade agreements. The current administration's resistance to trade hands economic advantages and influence to China, that would otherwise go to America.

That's not to say US trade policy can't be strengthened. From supporting education and research to reversing violations of trade rules, from strengthening digital and Pacific trade to reforming the World Trade Organization, there are clear actions that would advance US competitiveness. But first, America needs to decide that it should—and will—engage.

About the author

Mark Kennedy, Director of the Wilson Center's Wahba Institute for Strategic Competition, is dedicated to strengthening America's alliances and their mutually beneficial economic power projection. Kennedy applies experiences as a first-generation college graduate, Congressman, university president, senior officer of company now called Macy's, presidentially appointed member of the Advisory Committee for Trade Policy and Negotiations, founder of the Economic Club of Minnesota and author of an Ivy League published book. He has engaged wide cross-sections of society in over 45 countries, including refugee camps and war zones. An appointed Civic Leader supporting the Secretary of the Air Force, Kennedy has visited over 40 military bases and three aircraft carriers at sea.